Electronic invoice. From 1 January 2019, only electronic invoices will be issued.

They will cover the sale of goods and services rendered between residents, established or identified in the territory of the state and for the relative variations.

Starting from the first of every month we are going to go from registers and paper documents to better serve our customers who do not have access or prefer an online payment processing method, since many people these days rely exclusively on their phones instead of having different forms requiring signatures like checks, which makes it all the more difficult when trying to track down those important data like renewal deadlines etc.

The new system should provide a number of benefits for all parties involved, including easier access times, as well as enhanced security measures with an additional layer of protection against identity thieves who are constantly searching for our private information online.

The restaurant owner is excited to start his new project. They are working with a company that sends invoices electronically, and so far it’s going great!

This new service will allow them to spend less time sending paper copies of invoices, while maintaining up-to-date registrations in the system for tax purposes and for potential customers who may prefer not to receive anything other than an e-emails from this company right when they open every morning. The only downside may be some data protection concern as no physical copy can be delivered if there are problems during transmission, but other measures should help alleviate these concerns.

Electronic invoice

The electronic invoice will therefore become the only way to issue tax documents.

Restaurants will also be obliged to issue electronic invoices.

The electronic invoice is a digital process of issuing, transmitting and archiving invoices.

Starting from March 31, 2015, all invoices issued to the Public Administration must be in electronic format.

The implementation of the e-invoicing software was an area that lacked transparency when it came to knowing how much profit your servers earn from you as individual customers. This change should help restaurants to clarify the odds in favor so that they can better support workers who earn less than what might seem right given their level of experience or the skill set needed in every particular restaurant.

Under the new law, restaurants will have to issue electronic invoices. This should make it easier for customers and increase sales because they can view purchase logs on their phone or computer without having to go through cumbersome paper documents.

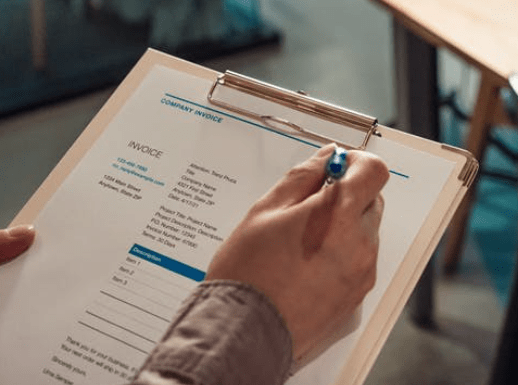

The electronic invoice is not a simple file attached to an email

Electronic invoice

In fact, electronic invoices are generated in XML format, digitally signed and transmitted to the Financial Administration through an interchange system (SDI). The electronic signature guarantees the authenticity of the origin and integrity of the contents.

Finally, digital preservation under the law is the last aspect of the process. Through the addition of a further digital signature and a time stamp on the electronic archive, the invoices are kept for the period prescribed by the legislation (10 years) in digital format.

Every restaurant is faced with the problem of electronic invoicing 2019 restaurants today

Electronic invoice

In fact, the electronic invoice issuing must necessarily provide for communication with the Inland Revenue exchange system.

The procedure provides:

Compilation of the electronic invoice;

Digital signature;

Sending to the SDI (interchange system);

Delivery of the document to the recipient;

Preservation of the document for 10 years.

How will electronic restaurant invoicing work?

Electronic invoice

Restaurant electronic invoicing will have to provide a system for compiling and transmitting the document, both to consumers and businesses.

Although there are still doubts about the identification mechanism of private consumers, the mechanism for sending electronic invoices to businesses is clear.

For B2B recipients, in fact, there are two ways of sending. Pec or Recipient Code of the Interchange System.

Each restaurant, therefore, will have to generate the invoices in XML format, sign them and send them to customers in the manner described above, as well as, of course, to the Revenue Agency.

The obligation of electronic invoice for restaurants

From an operational point of view, after a short period of adjustment, a progressive improvement in billing management should be recorded.

The interchange system, in fact, will behave like a sort of postman. The invoice will be sent to the customer and to the Revenue Agency, but also to the accountant. It will be enough to import the file into the various accounting applications and then to register the document.

Substitutive storage of electronic invoices

After checking the technical requirements, the electronic invoice can be stored in digital format. This operation will involve the affixing of a further digital signature, so as to guarantee its authenticity and compliance with the law.

Preservation is an IT procedure able to confer legal value over time to the electronic document.

And you, how do you manage your restaurant?

Do you envisage cost control or electronic invoicing systems?

Read also: Tax receipt and electronic receipt