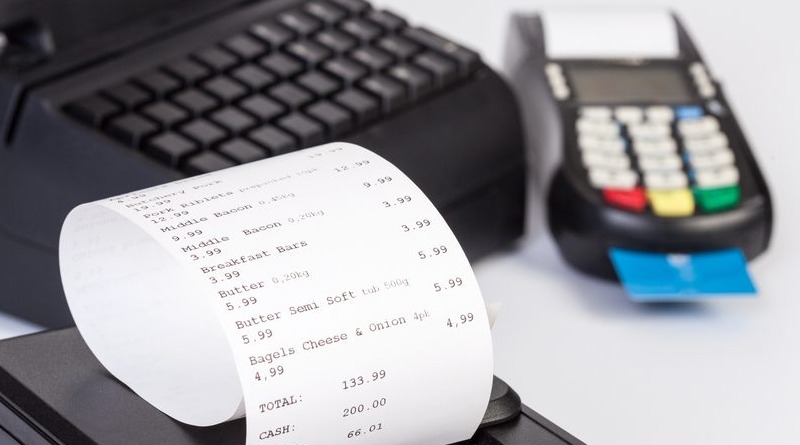

Tax receipt and electronic receipt, what can we expect?

A business or self-employment activity brings the need to produce a fiscal document testing the sum received as compensation. This document can be an invoice or a tax receipt and is necessary for any type of service.

Tax receipt and electronic receipt

The Electronic Restaurant Receipt, or Electronic Restaurant Tax Receipt, similar to what happens for the electronic restaurant invoice, is nothing more than a mode of transmission of data relating to the fees.

Through the portal Invoices and Fees of the Revenue Agency, in fact, restaurants can access the personal area, where it will be possible to send the data on the daily receipt of closing tax.

The telematic transmission of fees is the implementation of the cd. Electronic Invoicing Between individuals, which will take place through the issuance of the Electronic Receipt, also known as the e-invoice.

The electronic receipt covers the activities of retail, hotel, catering, craft services and all other activities similar to these by VAT, required to issue the invoice only at the request of the customer. (Art. 22 DPR No. 633/1972).

Tax receipt and electronic receipt

Now let’s see what it is all about

The famous tax receipt is a document, issued by the operators, which describes the goods sold or the service performed and the consideration received. It does not contain the breakdown of VAT or the references of the person making the payment. The tax receipt is issued in place of the receipt unless the customer specifically requests the invoice. The tax receipt is generally completed in duplicate, on printed documents with progressive numbering and all the fiscal references of the issuing subject. The law allows the operator to choose between issuing a receipt or both. In e-commerce transactions the document is called a purchase receipt.

Tax receipt and electronic receipt

The invoice, on the other hand, is a fiscal document that is issued to holders of VAT numbers, that contains the tax information of both the person who issues it and the person who pays it. When you find yourself having to pay an occasional benefit (up to € 5,000 a year there is no need to have a VAT number), simply fill out a simple receipt. Instead, it is fundamental to report the amount net of withholding tax at 20% specifying the occasional service performed.

So what is the situation regarding the tax receipt and the electronic receipt, what can we expect?

Recently we have had to confront the debug at the beginning of 2019 for obligation of electronic invoicing in transactions between “private”. From 1 July 2019 the Inland Revenue has confirmed that it will no longer be possible for paper receipts or receipts to be issued. In fact the perceived fees are now documented through the transmission of daily data and using electronic storage.

Tax receipt and electronic receipt

The customer is issued a document valid for tax purposes integrated with the tax code or VAT number of the buyer. The receipts will also be sent online to the Revenue Agency. The obligation is immediately valid for tax payers with a turnover exceeding 400 thousand euros. Starting from 1 January 2020, however, the obligation will be extended to all other subjects. For the fulfillment of these measures, taken in order to counter tax evasion, it will be necessary to have suitable Telematic Recorders which will obviously involve a cost.

However, don’t panic, you can gradually move towards these changes. You will be evaluated based on the type of activity and possible web connectivity difficulties in the area in which you operate. For the two-year period 2019-2020 traders will be able to benefit from a contribution equal to 50% of the sustained expenditure. It will be possible to obtain, within the limit of 50 euros in the case of adaptation of a recorder already in possession, and of 250 euros if a new purchase is made.

For the specifics regarding the transition from cash register to the on-line one it is necessary to read the provision of the Revenue Agency n. 182017/2016 having all the necessary technical characteristics. The operations that require certification through a commercial document are disclosed by the Art. 22 DPR 633-1972 (Retail trade and similar activities).

Read also: What is the electronic receipt?